Is “Just Answer the Question” Good Deposition Advice?

“Just answer the question” is standard deposition advice. But is that always the best advice? And can people actually follow it?

“Just answer the question” is standard deposition advice. But is that always the best advice? And can people actually follow it?

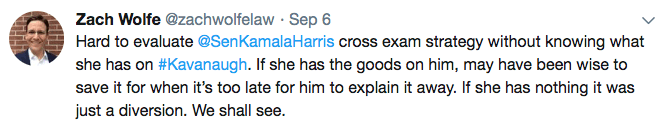

Let’s set aside the politics of the Brett Kavanaugh Supreme Court confirmation hearings for five minutes (as if that were possible). What can litigators learn about effective cross-examination from Senator Kamala Harris’s grilling of Judge Brett Kavanaugh about a possible discussion of the Mueller investigation with a law firm that represents Donald Trump? The reviews of Harris’s performance were all over the map. Some gushed over the former prosecutor’s toughness and cross-examination prowess. Others, especially fellow litigators, scoffed like she was an amateur. (I imagine the latter is similar to the way jealous stand-up comedians review each other.) And strangely […]

On February 5, 2018, the day after the real Super Bowl, the Super Bowl of trade secrets trials started in federal court in San Francisco. You might have heard of some of the parties. The defendant was Uber. You may not have heard of the plaintiff, Waymo, but you probably know Waymo’s owner, a little company called Google. The issue in a nutshell: did Google engineer Anthony Levandowski steal Google’s confidential self-driving car technology—they call it “LiDAR”—and take it to Uber? This is the type of “departing employee” case I like to handle (on a slightly smaller scale), so it […]

Bad emails. Trial lawyers love them and hate them. When your client sends them, there’s nothing worse. When the person you’re suing sends them, there’s nothing better. Scratch that. There is one thing better: when the person you’re suing changes his story after you confront him with bad emails he didn’t know you had. Let’s consider a hypothetical. Paula Payne Windows v. Dawn Davis Dawn Davis was a salesperson for Paula Payne Windows, a wholesaler that supplies windows to builders in the construction industry. Paula Payne maintained a Master Customer List containing detailed information about all of its customers. Dawn […]

The primary practical effect of the Defend Trade Secrets Act has been to shift a lot of typical customer list cases from state to federal court.

The Orchestratehr v. Trombetta case shows that some basic Texas non-compete issues remain unresolved.

Highland Capital case shows what evidence is needed to uphold a Texas trade secrets injunction

Ken Starr’s interview with a Waco TV station was a disaster, but it can teach lawyers valuable lessons about witness preparation.